Introduction

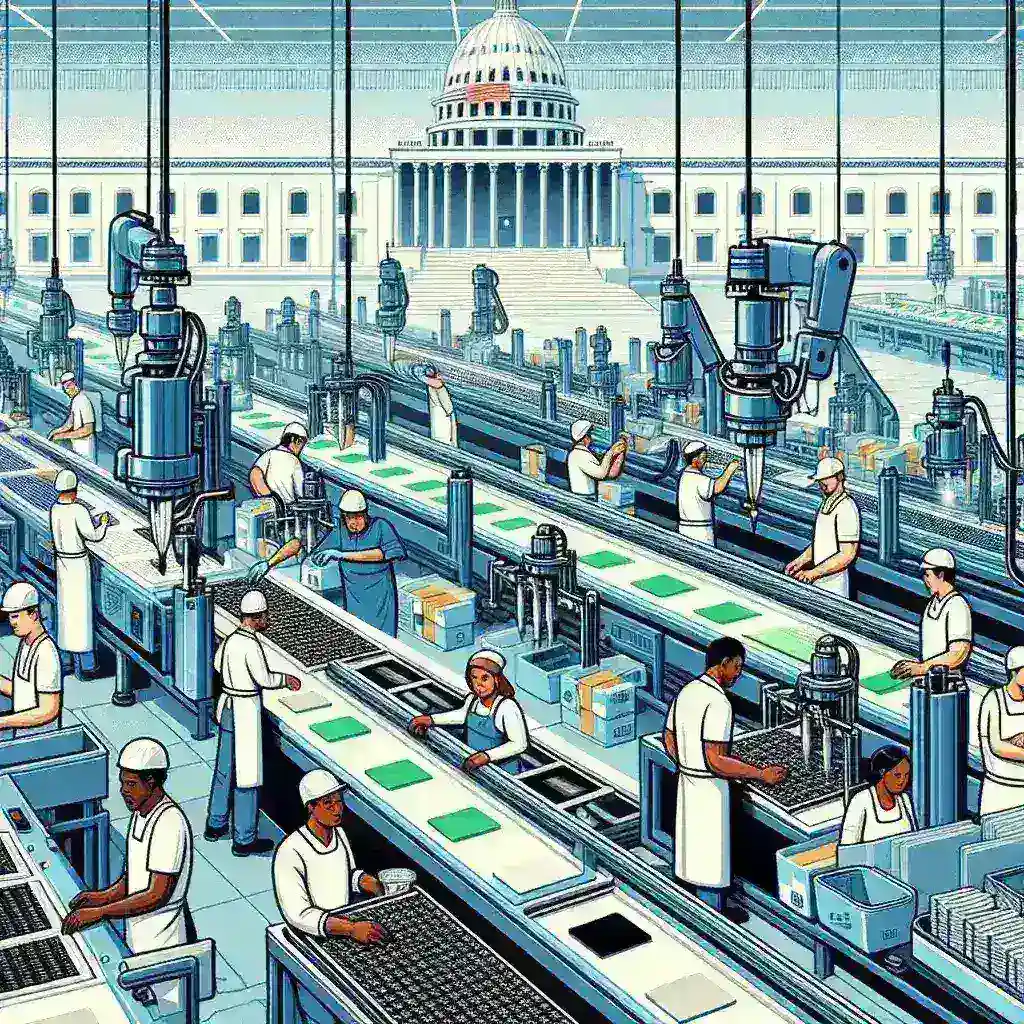

The semiconductor industry has taken center stage in the global economy, especially in the United States. With the passage of the latest bill aimed at bolstering domestic chip manufacturing, US chipmakers are set to receive larger tax credits. This move is expected to revolutionize the industry, attracting significant investments and enhancing the country’s competitiveness on the world stage.

Historical Context

To understand the significance of this legislative development, it’s essential to explore the historical backdrop of the semiconductor industry in the US. The United States has been a pioneer in chip manufacturing since the 1950s, leading the world in innovation and production. However, the landscape began to shift as companies increasingly outsourced production to countries with lower labor costs, particularly in Asia. By the late 2000s, fears grew about the US’s declining share of global semiconductor production, prompting calls for revitalization.

The CHIPS Act

In response to these concerns, the CHIPS (Creating Helpful Incentives to Produce Semiconductors) Act was introduced in 2021. This legislation aimed to provide incentives for US manufacturers to invest domestically. The latest bill builds upon this foundation, offering larger tax credits to chipmakers, thereby enhancing the competitive landscape.

Key Features of the Latest Bill

The recent legislation introduced several key features designed to benefit US chipmakers:

- Larger Tax Credits: The bill provides more substantial tax credits for research and development (R&D) as well as investment in manufacturing facilities.

- Investment in Workforce Development: A portion of the funds is allocated for workforce training programs to ensure a skilled labor force.

- Support for Innovation: The legislation promotes collaboration between the government and private sector, fostering innovation through public-private partnerships.

Impact on the Semiconductor Industry

The implications of larger tax credits for US chipmakers are vast:

1. Increased Investment

With enhanced tax credits, companies are more likely to invest in new technologies and manufacturing facilities. This increased investment is expected to lead to job creation and economic growth in regions where these facilities are established.

2. Enhanced Global Competitiveness

By revitalizing the domestic semiconductor manufacturing base, the US aims to reclaim its position as a leader in the global market. This move is crucial, especially considering the ongoing global semiconductor shortage.

3. Supply Chain Resilience

The COVID-19 pandemic exposed vulnerabilities in the global supply chain. By increasing domestic production, the US can reduce its dependency on foreign sources, thereby increasing supply chain resilience.

Challenges Ahead

While the bill presents numerous advantages, several challenges need to be addressed:

- Implementation: The efficient execution of the bill is critical. It requires coordination between various government agencies and the private sector.

- Workforce Shortages: Although the bill allocates funds for workforce development, attracting and retaining skilled workers in the semiconductor industry can be challenging.

- Global Competition: Other countries are also ramping up their semiconductor initiatives, which could lead to increased competition for investments and talent.

Future Predictions

As US chipmakers begin to leverage the larger tax credits, several predictions can be made about the future:

1. Growth of the Semiconductor Ecosystem

We can expect to see a significant growth in the semiconductor ecosystem, with new startups emerging alongside established companies. This growth will likely foster innovation and collaboration within the industry.

2. Increased Research and Development

With more substantial tax credits for R&D, companies will be incentivized to innovate, leading to advancements in chip technology, such as improved performance and energy efficiency.

3. Long-term Economic Growth

Investments in the semiconductor industry are expected to have a ripple effect on the broader economy, creating jobs and boosting local economies across the nation.

Conclusion

The latest bill providing larger tax credits for US chipmakers marks a significant turning point for the semiconductor industry. By fostering domestic production, enhancing innovation, and creating jobs, the legislation aims to not only strengthen the US’s position in the global market but also ensure a resilient supply chain for the future. As the industry moves forward, it will be crucial to address the challenges ahead to fully realize the potential benefits of this historic legislation.